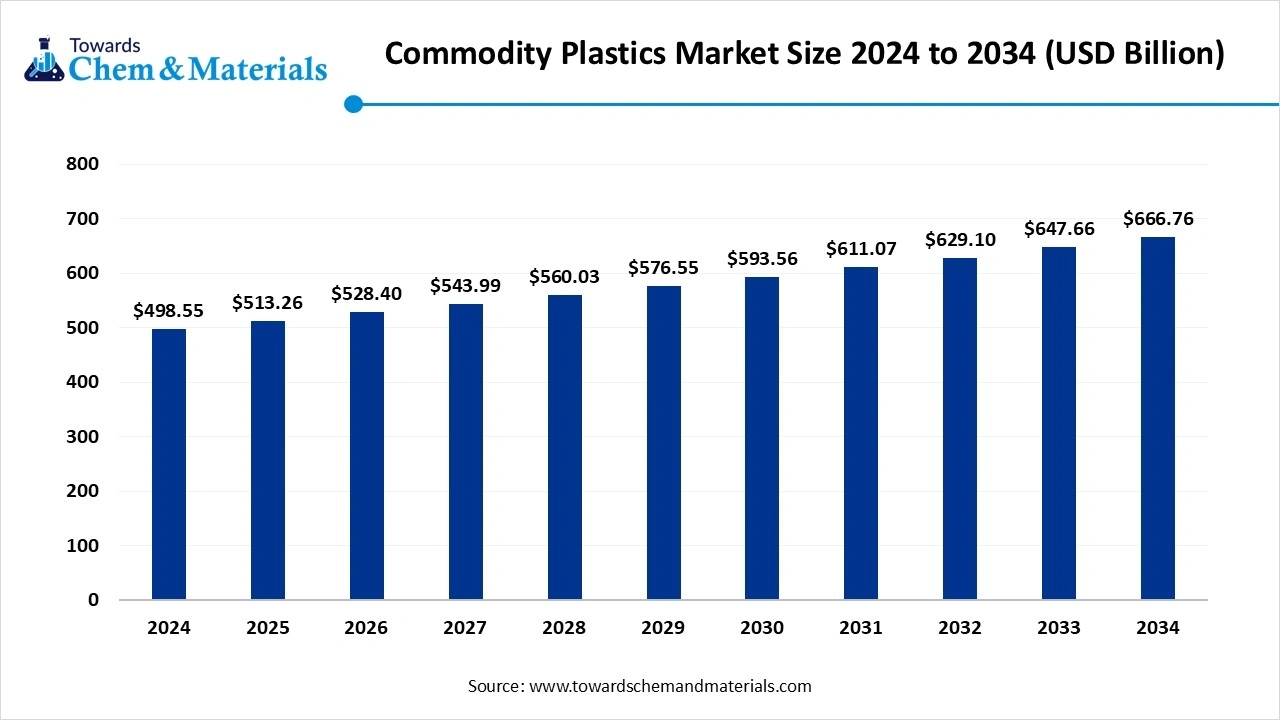

Commodity Plastics Market Size to Worth USD 666.76 Billion by 2034

According to Towards Chemical and Materials, the global commodity plastics market size is calculated at USD 513.26 billion in 2025 and is expected to be worth around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period 2025 to 2034.

Ottawa, Oct. 06, 2025 (GLOBE NEWSWIRE) -- The global commodity plastics market size was valued at USD 498.55 billion in 2024 and is anticipated to reach around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Increasing demand for lightweight and cost-effective materials across automotive, packaging, and consumer goods industries is driving the growth of the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5878

Commodity Plastics Overview

The commodity plastics market revolves around mass-produced, low-cost polymers such as polyethylene, propylene, PVC, and polystyrene which serve as backbone materials for a broad spectrum of industries including packaging, construction, automotive, consumer goods, and electrical and electronics because they offer ease of processing, adaptability in form (films, sheets, pipes, containers), and favourable cost to performance. Growth is bolstered by escalating demand for lightweight and durable materials, expansion of e-commerce which drives needs, and ongoing investments into recycling and bio-based plastic innovations, making the sector a crucial mode in the transition toward more sustainable materials.

Commodity Plastics Market Report Highlights

- The Asia Pacific commodity plastics market size was valued at USD 239.30 billion in 2024 and is expected to reach USD 320.44 billion by 2034, growing at a CAGR of 2.97% from 2025 to 2034. Asia Pacific dominated the market with approximately 48% share in 2024.

- By region, Asia Pacific dominated the market with approximately 48% share in 2024.

- By region, Middle East & Africa is expected to grow at the fastest CAGR over the forecast period.

- By product type, the polyethylene segment dominated the market with approximately 42% share in 2024.

- By product type, the polypropylene segment is expected to grow at the fastest CAGR over the forecast period.

- By manufacturing process, the extrusion segment held approximately 46% market share in 2024.

- By manufacturing process, the injection moulding segment is expected to grow at the fastest CAGR over the forecast period.

- By end-use industry, the packaging segment dominated the market by holding approximately 40% share in 2024.

- By enterprise size, the large enterprises segment dominated the market with approximately 62% share in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5878

Commodity Plastics Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 528.40 billion |

| Revenue forecast in 2034 | USD 666.76 billion |

| Growth rate | CAGR of 2.95% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Manufacturing Process, By End-Use Industry, By Enterprise Size, By Region |

| Key companies profiled | BASF SE., SABIC, Dow Inc., DuPont de Nemours, Inc., Evonik Group, Sumitomo Chemical Co., Ltd., Arkema, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Exxon Mobil Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some of the Top Products in the Commodity Plastics Market

- Polyethylene (PE)- Most widely used plastic; used in bags, bottles, films, containers. Includes HDPE, LDPE, LLDPE.

- Polypropylene (PP)- Durable and resistant; used in packaging, automotive parts, textiles, and household goods.

- Polyvinyl Chloride (PVC)- Used in construction (pipes, windows), medical devices, and electrical cable insulation.

- Polystyrene (PS)- Rigid or foam; used in food containers, packaging, and disposable cutlery.

- Expanded Polystyrene (EPS)- Lightweight foam; used in insulation, packaging, and disposable food containers.

- Polyethylene Terephthalate (PET)- Used in beverage bottles, food containers, and textiles (polyester).

- Acrylonitrile Butadiene Styrene (ABS)- Tough and impact-resistant; used in electronics, toys (e.g., LEGO), and appliances.

- Polycarbonate (PC)- High clarity and strength; used in eyewear, electronics, automotive, and construction.

- Polyamide (Nylon)- Strong and wear-resistant; used in textiles, automotive, and industrial components.

- Polymethyl Methacrylate (PMMA)- Also known as acrylic or Plexiglas; used in displays, windows, and lighting.

What Are the Major Trends in the Commodity Plastics Market?

- Increasing investment in recyclable, biodegradable, and bio-based plastics is reshaping material portfolios in the industry.

- Expansion of manufacturing capacity and upgrades in infrastructure, especially in emerging economies, to meet growing demand.

- Growing adoption of closed loop systems and material recovery to reduce environmental impact.

- Rising use of lightweight, durable, and flexible plastics across packaging, automotive, and consumer goods sectors.

- Pressure from sustainability, regulation, and consumer preference driving innovation in recycling and circular economy models.

How Does AI Influence the Growth of the Commodity Plastics Market In 2025?

In 2025, AI expected to accelerate the growth of the commodity plastics market by optimizing production, improving material design, and enhancing sustainability, leveraging machine learning, manufacturers can predict defects, fine tine process parameters, and minimize waste, AI driven analytics enable formulation of novel polymer blends tailored for performance and recyclability, and intelligent systems improve supply chain forecasting and reverse logistics, all together making production more efficient, cost-effective, and better aligned with circular economy goals.

Commodity Plastics Market Growth Factors

Is Sustainable Packaging Fuelling A New Wave Of Plastic Demand?

Growing pressure from retailers and consumer brands to reduce waste is pushing innovation in recyclable and bio-based commodity plastics. Major packaging producers such as Coca-Cola and Unilever have announced public commitments to increase the use of recyclable plastic formats, encouraging suppliers to scale affordable alternatives to traditional resins. As a result, even low-cost plastics like p0olythylene and polypropylene are being reformulated to work seamlessly in existing recycling streams. This creates not only replacement demand but entirely new product categories that did not previously exist.

Can Smart Manufacturing Make Plastics Cleaner and Cheaper At the Same Time?

Plastic converters are rapidly deploying AI powered monitoring tools to cut energy usage and reduce defective output during moulding and extrusion. Companies like BASF and Dow have publicly showcased AI assisted production lines that adjust temperature, pressure, and cooling in real time to optimize quality. Lower production losses translate to more efficient use of raw materials, which strengthens profitability even when resin prices fluctuate. This technological shift is turning traditional plants into self-learning facilities capable of scaling output with fewer resources.

Market Opportunity

Can AI Driven Sorting Boost Recycling Efficiency?

AI assisted sorting systems are being developed to better distinguish and separate different plastics types from waste streams, which helps reduce contamination and improve the yield of recyclable commodity plastics. For example, researcher at the University at Buffalo highlight hoe AI guided automated sorting can refine separations across mixed waste inputs. The enhanced recycling feedstock strengthens the supply of secondary plastics, reducing reliance on virgin resins and encouraging circularity in the commodity plastics sector.

Will AI Help Design Next-Gen Recyclable Polymers?

Teams at institutions like Washington University and UC Berkeley are using AI to design novel polymers that retain desired performance while being more easily recycled or deconstructed. This approach accelerates materials innovation, lowers research and development timelines, and aligns commodity plastics with sustainability goals, fuelling broader adoption by brands seeking greener materials.

Limitations In The Commodity Plastics Market

- Fluctuating raw material arability and dependency on fossil-based feedstock create uncertainty for producers and users of commodity plastics.

- Rising environmental scrutiny and tightening regulations around waste management and emissions, make it challenging for manufacturers to maintain traditional production methods.

Commodity Plastics Market Segmental Insight

Product Type Insights

Which Product Type Holds the Largest Share in Commodity Plastics Market?

The polyethylene segment dominated the market in 2024, due to its low cost, versatility, and extensive adoption in packaging applications. Polyethylene’s excellent flexibility, resistance, and durability make it suitable door a wide array of applications, from containers and bottles to films and sheets. The growth of the e-commerce sector has further driven the demand for polyethylene, as it is widely used in packaging materials. Its adaptability across various industries has solidified polyethylene’s position as the leading product type in the commodity plastics market.

The polypropylene segment is anticipated to experience the fastest growth in the market during the forecast period. This growth is driven by polypropylene’s increasing adoption in various applications, including automotive parts, textiles, and packaging materials. Its lightweight nature, chemical resistance, and versatility make it an attractive option for manufacturers seeking cost-effective and durable materials. The expanding demand for polypropylene in emerging markets is further fuelling its rapid growth. These factors position polypropylene as the fastest-growing product type on the commodity plastics market.

Manufacturing Process Insights

Which Manufacturing Process Holds the Largest Share in the Commodity Plastics Market?

The extrusion segment held the largest share of the market in 2024, owing to its efficiency in producing continuous profiles and sheets. Extrusion is widely used in the production of pipes, films, and sheets, catering to industries such as construction, packaging, and automotive. The processes’ ability to produce high volumes at a relatively low cost made it a preferred choice manufacturer. Additionally, advancements in extrusion technologies have improved product quality and production speeds, further solidifying its dominance in the market.

The injection segment is expected to experience the fastest growth in the market in the forecast period. This growth is attributed to the increasing demand for precision moulded components across industries such as automotive, electronics, and consumer goods. Injection moulding allows to produce complex and lightweight pars with high dimensional accuracy and repeatability, making it ideal for mass production. The versatility and efficiency of injection moulding are driving its rapid adoption, positioning it as the fastest growing manufacturing process in the market.

End Use Industry Insights

Which End Use Industry Holds the Largest Share?

The packaging segment dominated the market in 2024, accounting for a significant portion of the market share. The widespread use of plastics in packaging materials, including bottles, films, and containers, has driven this dominance. The growth of the e-commerce sector has further amplified the demand packaging materials, as efficient and protective packaging is crucial for product delivery. Additionally, the versatility and cost effectiveness of plastic packaging solutions have contributed to their widespread adoption across various industries.

The automotive segment is projected to experience the fastest growth in the commodity plastics market during the forecast period. This growth is driven by the increasing use of lightweight and durable plastic components in vehicles manufacturing to improve fuel efficiency and reduce emissions. Plastics are being utilized in various automotive parts, including interior panels, bumpers, and under the hood components. The automotive industry’s shift towards electric vehicles and the adoption of sustainable materials are further accelerating the demand for commodity plastics in this sector.

Enterprise Size Insights

Which Enterprise Size Holds the Largest Share In the Commodity Plastics Market?

The large enterprises segment held the largest share in the market in 2024. Large enterprises benefit from economies of scale, extensive distribution networks, and significant capital investments, allowing them to produce and supply commodity plastics efficiently. Their established presence in the market and ability to meet large volume demands have contributed to their dominance. Additionally, large enterprises often lead in technological advancements and innovation, further solidifying their position in the market.

The small and medium enterprises (SMEs) segment is expected to experience the fastest growth in the commodity plastics market during the forecast period. This growth is attributed to the increasing entrepreneurial activities and the rise of start-ups focusing on innovative plastics solutions. SMEs are agile and can quickly adapt to market trends, allowing them to capitalize on niche opportunities in the commodity plastics sector. Their ability to offer customized on niche opportunities in the commodity plastics sector. Their ability to offer customized and specialized products is attracting a growing customer base, positioning SMEs as the fastest growing enterprise size in the market.

Regional Insight

Why Is Asia Pacific Dominating the Commodity Plastics Market?

Asia Pacific captured largest share of the global commodity plastics market in 2024, driven by rapid urbanization, industrialization, and expanding end-use industries such as packaging, automotive, and healthcare. The region’s dominance is further supported by robust infrastructure development and a growing demand for lightweight, cost-effective materials. Countries like China and India are key contributors to this growth, with their increasing manufacturing capacities and consumer markets. Additionally, the region’s focus on sustainable practices and recycling initiatives is shaping the future of the market. These factors collectively position Asia Pacific as a leader in the global commodity plastics industry.

China and India are pivotal players in the Asia Pacific commodity plastics market, each contributing uniquely to its expansion. China’s rapid industrialization and urban development have led to increased demand for commodity plastics in construction, packaging, and automotive sectors. The country’s advancements in manufacturing technologies and infrastructure development further bolster this demand. India, on the other hand, benefits from its growing consumer base and expanding manufacturing capabilities, driving the need for commodity plastics in various applications. Both nations are also investing in sustainable practices and recycling initiatives, aligning with global trends towards environmental responsibility. Their combined efforts are significantly shaping the trajectory of the market in the region.

Why Is The Middle East And Africa The Fastest Growing Region In The Commodity Plastics Market?

Middle East and Africa (MEA) is experiencing rapid growth in the market, driven by strategic economic diversification and increased industrial activities. Countries like Saudi Arabia and the UAE are investing heavily in infrastructure and manufacturing capabilities, positioning themselves as key players in the global plastics industry. The region’s focus on developing sectors such as construction, automotive, and packaging is further fuelling demand for commodity plastics. Additionally, government initiatives aimed at promoting local production and reducing reliance on imports are contributing to the market’s expansion. These factors collectively make the MEA region the fastest-growing in the commodity plastics sector.

More Insights in Towards Chemical and Materials:

- Mechanical Recycling of Plastics Market : The global mechanical recycling of plastics market size was reached at USD 37.85 billion in 2024 and is expected to be worth around USD 92.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.39% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Transparent Plastics Market : The global transparent plastics market size was reached at USD 151.53 billion in 2024 and is expected to be worth around USD 245.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.93% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- Engineering Plastics Market : The global engineering plastics market size was reached at USD 146.95 billion in 2024 and is expected to be worth around USD 312.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.85% over the forecast period 2025 to 2034.

- High Performance Plastics Market : The global high performance plastics market size was valued at USD 26.85 billion in 2024 and is estimated to reach around USD 65.57 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 9.34% during the forecast period 2025 to 2034.

- Circular Plastics Market : The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034.

- U.S. Transparent Plastics Market : The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

- Europe Plastics Market : The Europe plastics market volume was reached at 55.10 million tons in 2024 and is expected to be worth around 64.32 million tons by 2034, growing at a compound annual growth rate (CAGR) of 1.56% over the forecast period 2025 to 2034.

Commodity Plastics Market Top Key Companies:

- LyondellBasell Industries

- SABIC

- Dow Chemical Company

- ExxonMobil Chemical

- INEOS Group

- Reliance Industries Limited (RIL)

- Borealis AG

- Braskem S.A.

- Formosa Plastics Group

- LG Chem

- Covestro AG

- Chevron Phillips Chemical

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- PetroChina Company Limited

- Westlake Chemical

- TotalEnergies Chemicals

- Arkema S.A.

- Mitsui Chemicals

- Hanwha Solutions

Recent Developments

- In September 2025, China’s rapid expansion in ethylene production is poised to influence global commodity plastics markets. With the country operating over 54 million tonnes per year of ethylene capacity and plans to increase this by 9% by 2030, the surge could lead to oversupply, affecting global pricing and competition. This development may challenge U.S. and European chemical manufacturers already facing weak demand.

- In September 2024, over 30 plastic manufacturing enterprises have expressed interest in investing a new plastic cluster being developed in Ujjain, Madhya Pradesh. The cluster, covering an area if 2.93 hectares in Nimanwasa, aims to foster growth in the plastic industry by providing infrastructure and resources to manufacturers. This development is anticipated to boost local employment and contribute to the region’s economic growth.

Commodity Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Commodity Plastics Market

By Product Type

- Polyethylene (HDPE, LDPE, LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Others (ABS, PMMA, Polycarbonate)

By Manufacturing Process

- Extrusion

- Injection Molding

- Blow Molding

- Compression Molding

- Others

By End-Use Industry

- Packaging (Flexible & Rigid)

- Automotive

- Construction & Infrastructure

- Electrical & Electronics

- Consumer Goods

- Healthcare & Medical Devices

- Textiles & Apparel

By Enterprise Size

- Large Enterprises (Global Plastic Manufacturers)

- Small & Medium Enterprises (Regional Producers)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5878

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.